Renting vs. buying, benefits of owning a home, and how to avoid risks

By Sophia Xu, Realtor, CPA

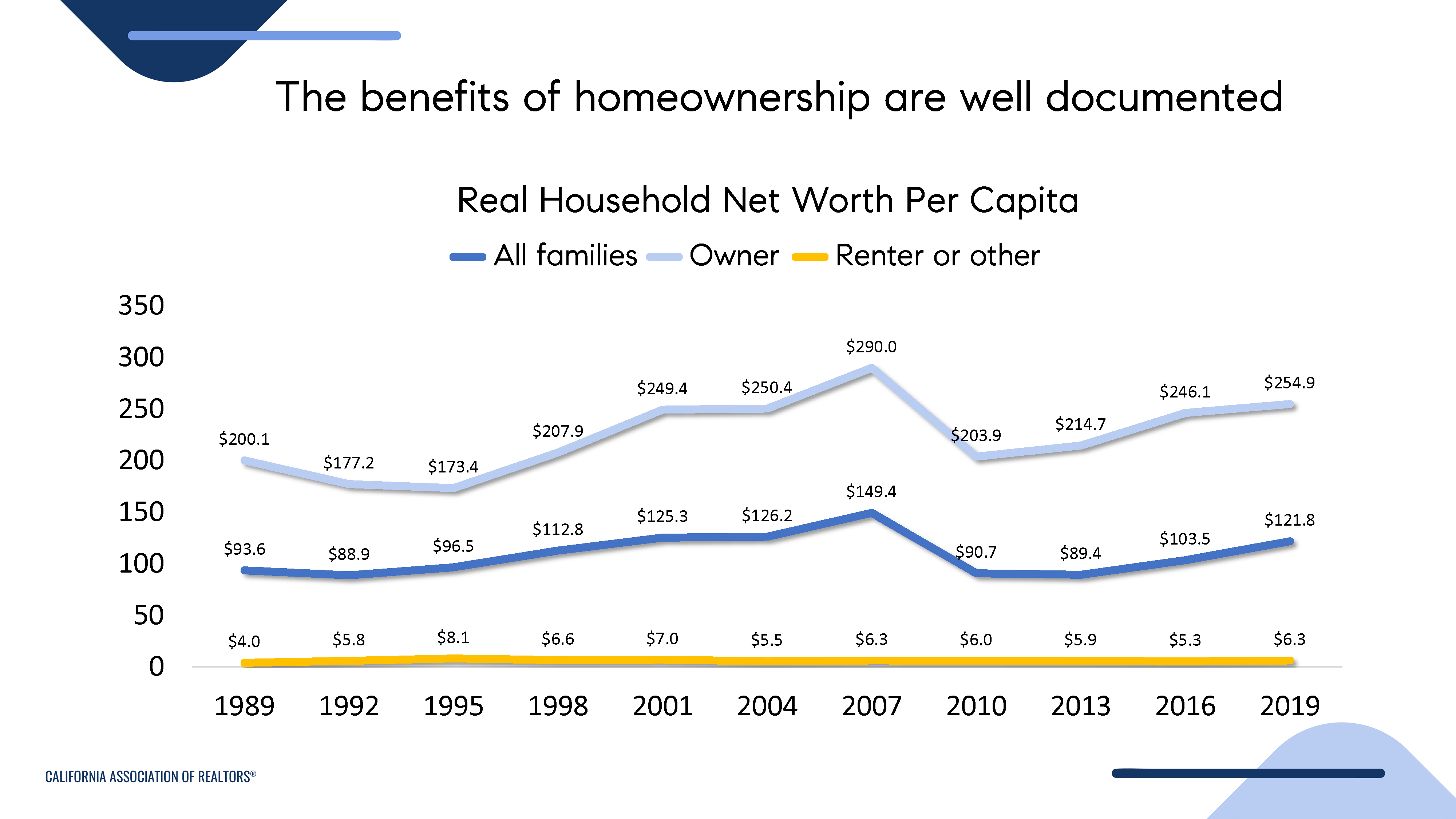

“Renting can make sense as a lifestyle choice or because of income constraints. As a means to building wealth, however, there is no practical substitute for homeownership.” - Homeownership and Wealth Creation, editorial in The New York Times*

Owning a Home is an Attractive Long-Term Investment

Typically, the purchase of a home is one of the largest financial transactions of one’s life. Owning a home has many aspects beyond the financial: Security, control, independence, pride of ownership, the ability to make changes and improvements according to your own tastes and needs. But it is also a financial investment and has often been a very good, or even a spectacular one, especially over the longer term. Here are seven reasons why owning a home is a good financial investment:

- Long-term economic, demographic and home-price appreciation trends: From January 2000 to May 2023, the Santa Clara County and San Mateo County house prices appreciated 187% and 205% respectively, according to the single-family-home sales reported on MLSListings. Consumer-price inflation rate is approximately 80% over the same period.

- Leverage: The option to finance much of the purchase price can supercharge the return on one’s cash down-payment and closing costs if values increase.

- The ability to lock in your mortgage payment: With a fixed-rate mortgage, a major portion of one’s housing costs remains stable for the entire period of the loan, while rents typically increase significantly with inflation (or rates higher than inflation). As the years or decades pass, this can add very substantially to the financial benefit of owning vs. renting.

- The “forced savings” effect: Beside potential appreciation gains, paying one’s monthly mortgage increases home equity as the outstanding loan is gradually paid down, an effect that accelerates over the life of the loan. While rents are basically money spent and gone, mortgage payments can quietly turn into very large, equity-based, financial assets.

- The tax deductibility of certain costs of homeownership

- The $250,000/$500,000 exclusion on home-appreciation capital gains taxation

- The option of turning your home into a rental property

Ways to Lower the Financial Risks of Homeownership

As an investment, owning a home also comes with risks as the market goes up and down. Unlike stock, which can be sold within minutes, homes typically take much longer to unload. There are a few things to keep in mind that might help you sail through the market downturns:

- The home you purchase should work for you now - it should fulfill your basic housing requirements at an affordable monthly cost.

- Keep a reserve fund in case of the unexpected developments that can come up in life.

- Buying for the longer term is generally safer as an investment: Though it can be profitable, buying and selling over shorter periods often carries greater risks and amortized costs.

- Refinance your existing mortgage into new, long-term, fixed-rate loans when significantly lower rates make this sensible per your expected timeline of ownership. (This can be an enormous financial advantage.)

- Avoid using your home as an ATM in times of appreciation, especially for non-essentials. If possible, allow your home equity to grow over time, like an untouchable savings or retirement account.

Perhaps more than any other decision, buying a home combines deeply personal, quality of life issues and substantial financial considerations, which only you can weigh according to your own circumstances, plans and priorities, and your projection of what the future holds.

Rent vs. Buy Decision

Comparing the exact financials of renting vs. buying over time is challenging, because the calculation depends on predicting a number of complex, often volatile economic factors, including:

- rental-cost appreciation over the period of projected home ownership

- the return one could generate on one’s downpayment if invested instead of being used to buy a home

- total home price appreciation over the period of ownership

- inflation over the period

- mortgage interest rates, at purchase and in the future

If you are unsure of whether or not to continue renting versus purchasing a home, I’d be happy to sit down with you to discuss your specific personal/financial circumstances and plans, review market and economic data, and run purchase scenarios, to help you make an informed decision. Quickly contact me by filling out this call request form or email me at Sophia@SophiaXu.com.