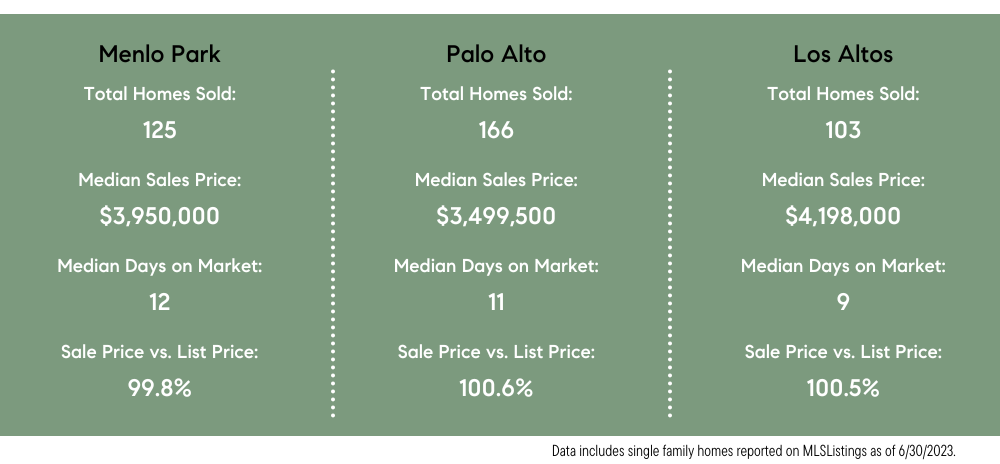

Year-to-Date Real Estate Update by City

The U.S. economy survived the first half of 2023 without going into a recession, as consumers turned out to be more resilient than most economists expected. Underlying market and economic dynamics have been a mixed bag of often contrary and volatile factors, including:

- downward-trending inflation;

- interest rates bouncing between 6% and 7%;

- unceasing uncertainty regarding what the Fed will do next;

- substantial rebounds in stock markets;

- bank, commercial real estate and debt-default crises;

- international political, economic and military conflicts; and

- high-tech layoffs amid generally strong employment statistics.

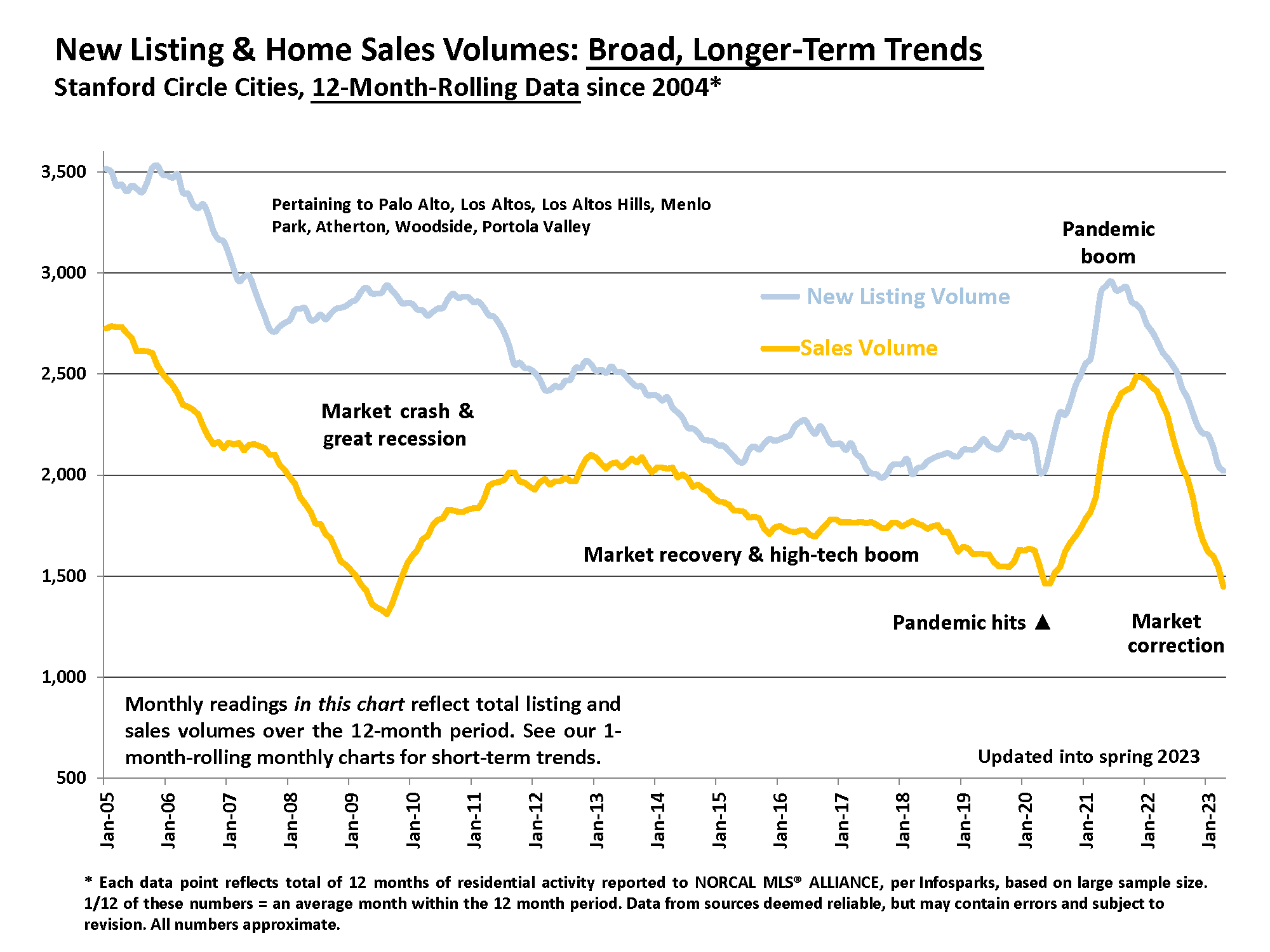

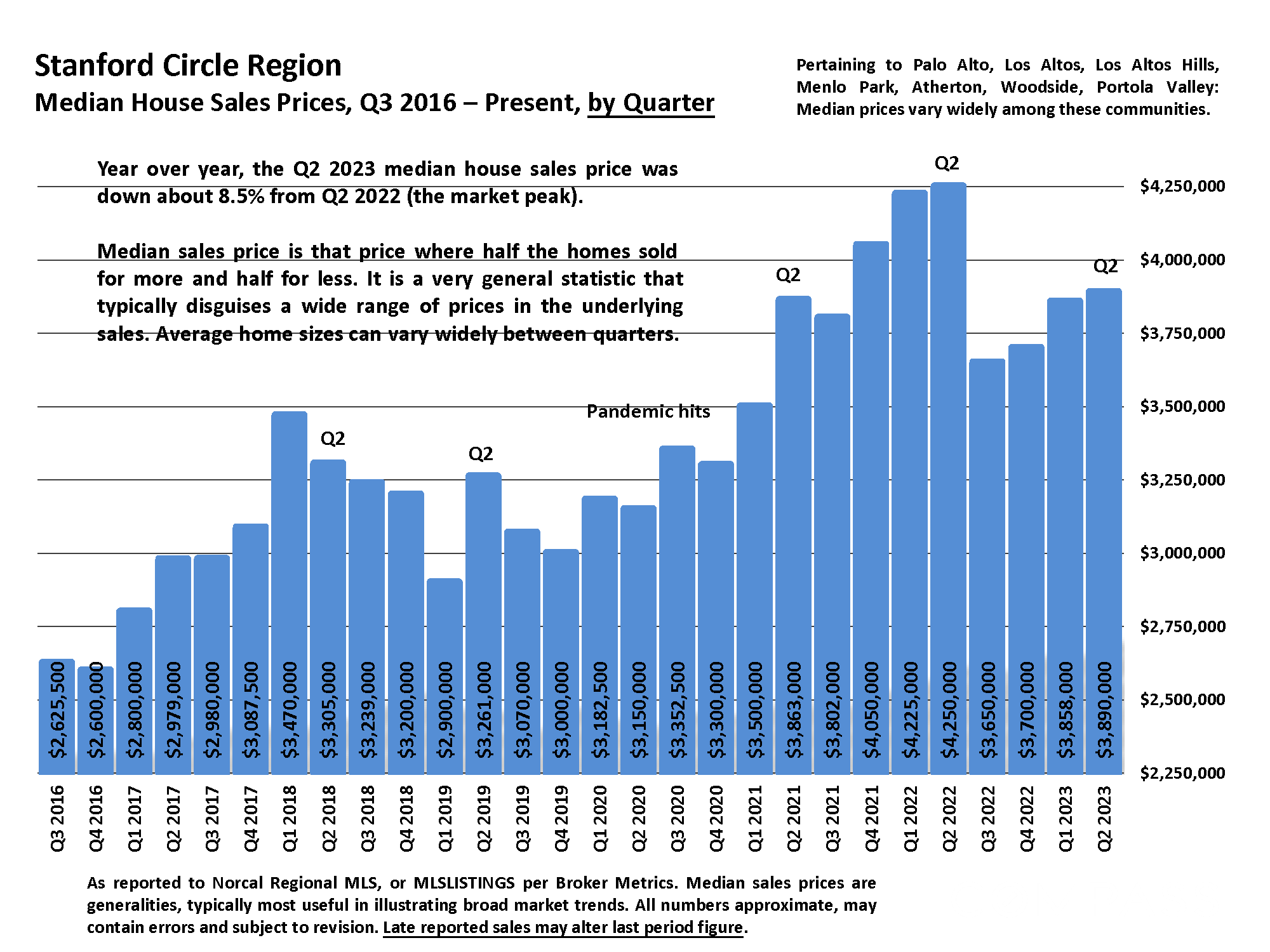

The housing market has continued to encounter headwinds since late 2022. We had a robust recovery in buyer demand, sales activity and home prices in the spring, but all these 3 indicators remained significantly lower than the peak of the market in spring 2022. Perhaps the biggest wild card has been severely depressed new-listing activity as potential sellers have held back – ascribed to the “mortgage lock-in effect” – which not only artificially constrained the number of sales, but put upward pressure on prices as buyers, once again, competed for an inadequate supply of homes for sale.

Though mortgage applications are still well down year over year, many buyers have accepted high interest rates as the new normal and decided to move forward with their life plans. As we’ve moved deeper into 2023, that balance of supply and demand has tilted increasingly to sellers’ advantage, with homes selling faster, with more offers, for higher prices.

The 1st and 4th largest insurers of CA homes, State Farm and Allstate, have announced they will no longer write new policies in the state due to rising claims costs. It is too early to quantify the exact financial and market effects of their actions, or if other insurers will follow suit.

* Stanford Circle includes Palo Alto, Los Altos, Los Altos Hills, Atherton, Menlo Park, Woodside, and Portola Valley.

MARKET OUTLOOK

For most Bay Area markets, summer has historically been a slower period after spring – with some regions seeing a relatively short (6 to 8 week) spike in activity in September and October before the big midwinter slowdown. Certainly, a substantial amount of buying and selling will continue to occur in coming months, as well as variations in underlying economic conditions.

If you are considering selling in 2023, pricing, preparation and marketing are now critical. Inventory is still tight in our area, and there are serious buyers out there. As long as we prepare it well, price it right and market it to the right buyers, we still can sell your home within weeks.

If you are considering buying in 2023, don't hesitate to negotiate aggressively, especially on homes with longer days-on-market. We'll never time the market right. If you have a good opportunity and it makes sense for your family, just do it. Your property tax will be lower for years to come, and you might be able to lower your monthly mortgage by refinancing in the future.

SCHEDULE A CALL WITH SOPHIA

If you are considering buying or selling and would like to discuss the current market condition, schedule a call with Sophia