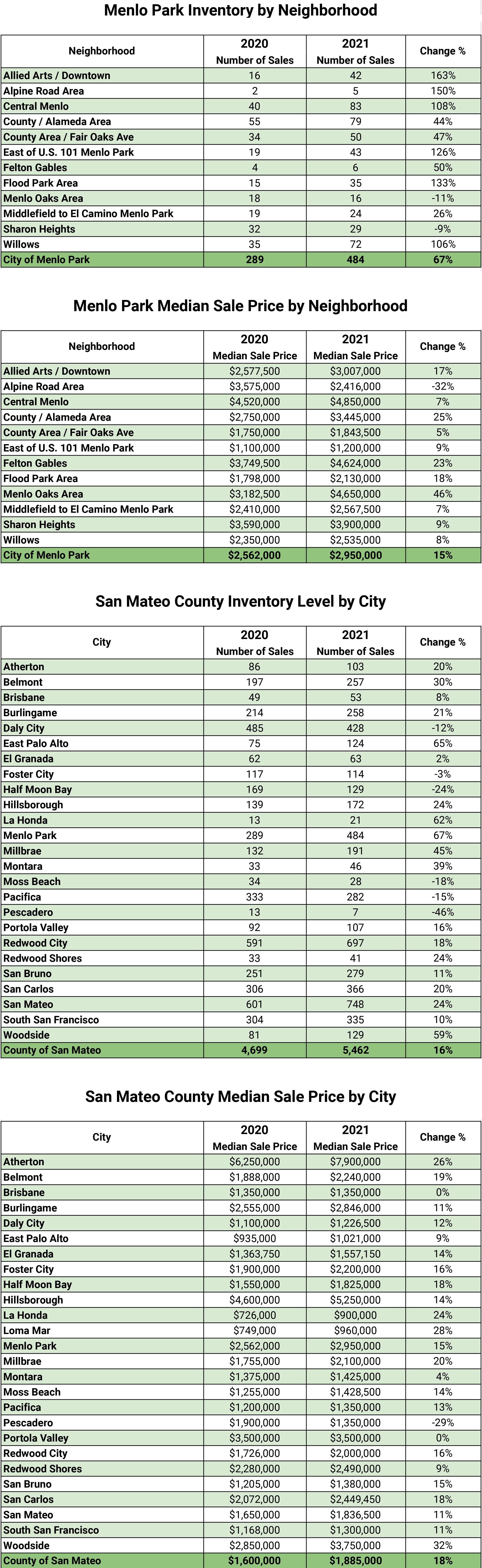

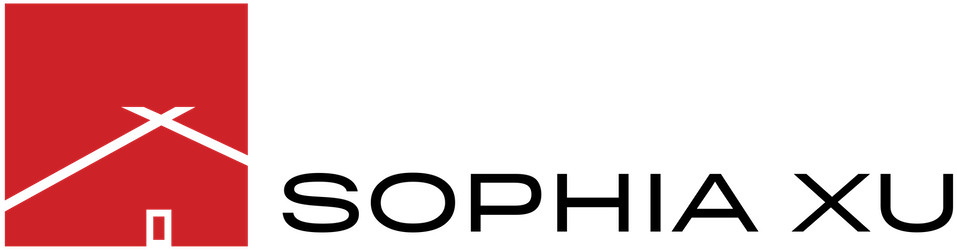

The housing market in the Bay Area was red hot in 2021 with home sales surging above 2020 by double digits. The number of homes sold in Santa Clara County increased by 27% in 2021 and by 16% in San Mateo County. Home prices continued to climb with the median price setting record highs multiple times throughout the year. Median home price increased by 18% in 2021 in both Santa Clara and San Mateo Counties.

Buyers

-

The imbalance between supply and demand created headaches for homebuyers, as market competition remained intense while housing affordability continued to decline.

-

Market competition was the most intense in the mid-priced range segment and remained more competitive for first-time buyers.

-

International buyers bounced back to the highest level since 2014

Sellers

-

Sellers had the largest net gain in 33 years after an increase of 54% from 2020. Home sellers who lived in their house for less than five years earned a 33.3% profit from their sales; those who lived in their house for five or more years earned a 135.1% profit.

-

Many sellers were moving out of California due to the declining housing affordability and the flexibility to work remotely. Sellers who planned to purchase their next home outside the state surged to 35% in 2021 from last year’s 30%. The increase was the biggest year-over-year jump in the last 16 years.

According to the California Association of Realtors, “housing demand is expected to stay solid in 2022, assuming that the pandemic situation will continue to improve. Supply constraints and high home prices will lower sales in 2022 but the decline will be modest, and annual home sales will reach the second highest level in the past five years. A favorable lending environment will continue to benefit the housing market as the average 30-year fixed rate mortgage remains below 3.5 percent for most of the year. Consumer finances will improve further as the economic recovery continues and will keep home buying interest alive.”